Private Equity Portfolio Management Software

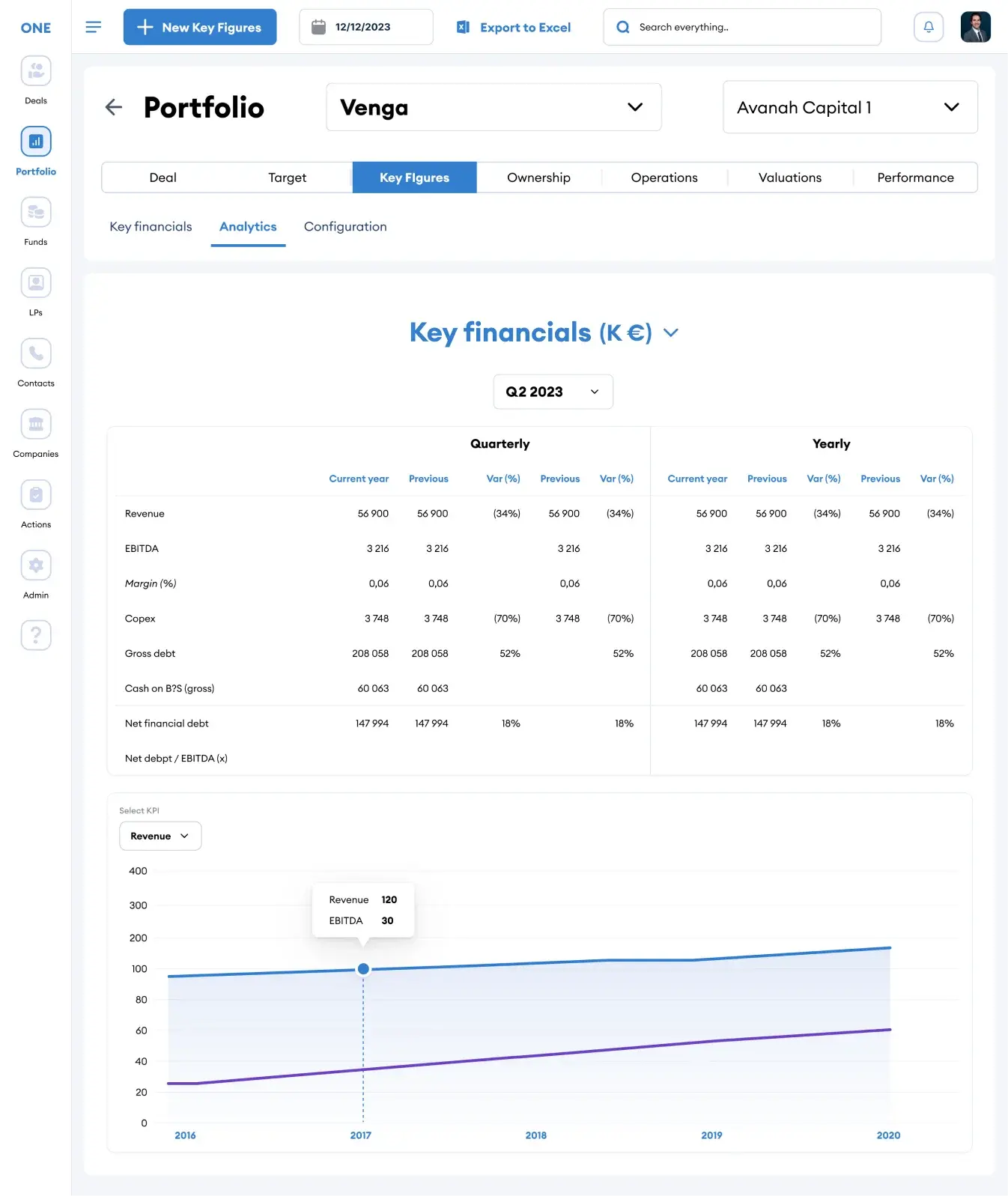

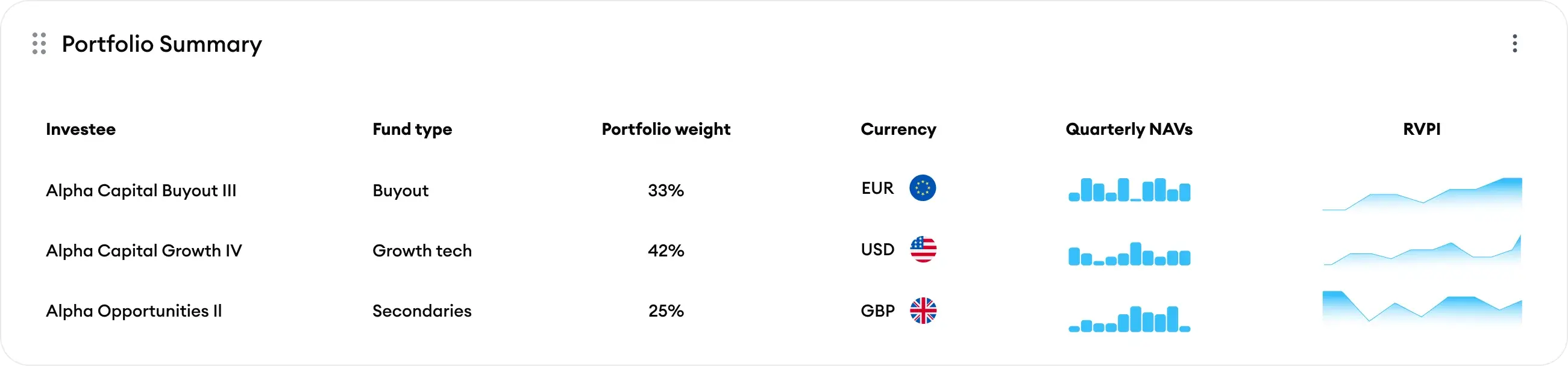

At DAVIGOLD, we recognize the crucial role of portfolio monitoring within the private equity sector. Our sophisticated tools are crafted to deliver a comprehensive view and insightful analysis of your portfolio's performance, equipping Limited Partners with an unparalleled monitoring solution.