Private Equity Deal Management Software

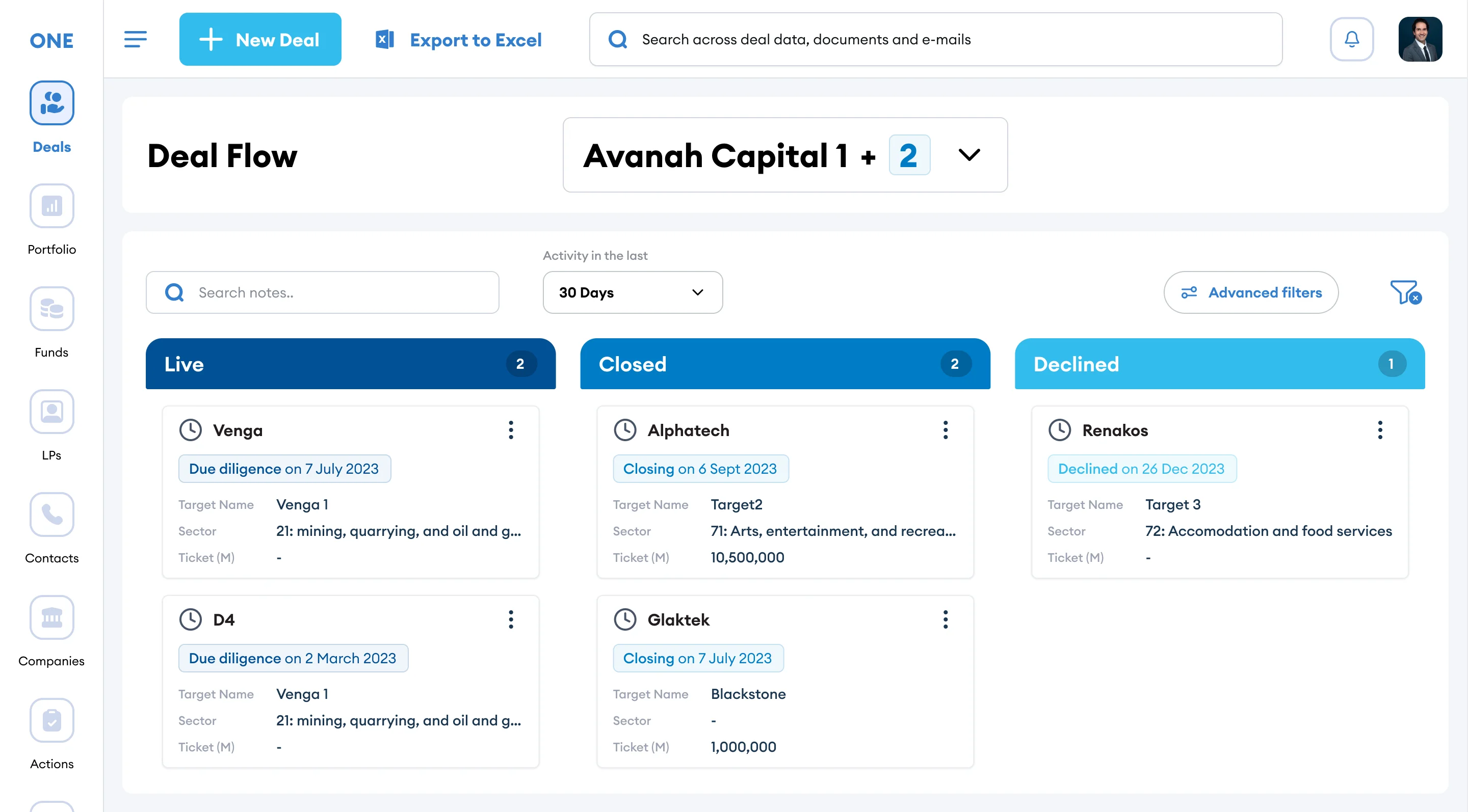

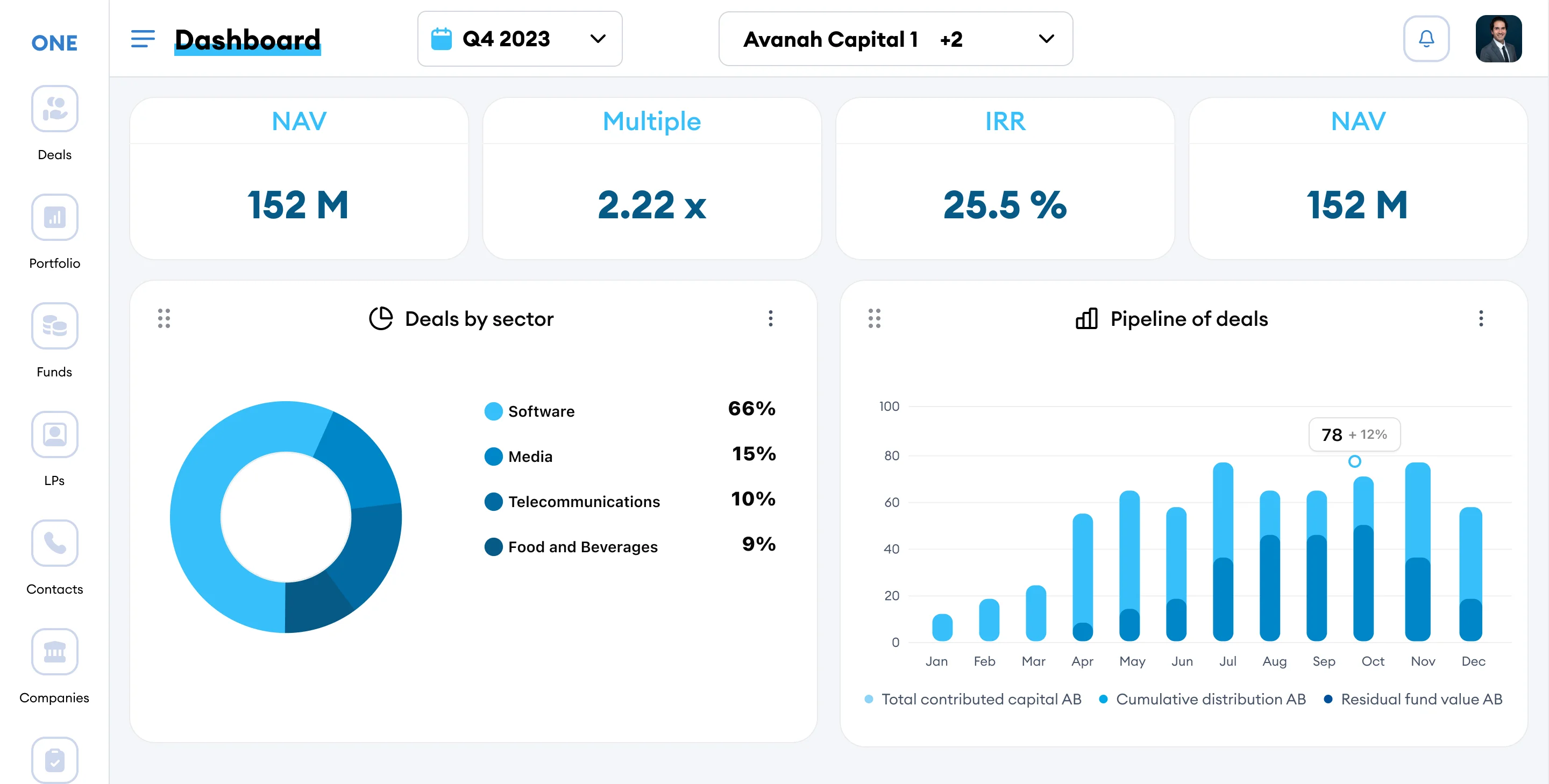

Understanding the critical role of deal flow management in Private Equity, DAVIGOLD provides tools designed to optimize your deal-making process. Our software offers a user-friendly interface for quick access to deals, a centralized repository for deal organization, customizable dashboards for analytics, AI-driven deal sourcing, and sophisticated algorithms for deal prioritization, enhancing the efficiency of PE Front Office teams.